Smart, Simple & Secure

Invest in mutual funds systematically and watch your wealth grow. Join our platform to set up an automatic monthly investment in minutes.

Don't just invest, invest with a purpose. Select your life goal, and we'll recommend the best SIP plan to achieve it on time.

Invested Amount

₹120,000

Resultant Amount

₹459,929

Profit

₹339,929

Here are some of the best SIP Plans of 2025 curated & customized just for your needs.

This step helps you select an investment option that suits your financial goals, time horizon, and risk comfort. Making the right choice ensures your money grows steadily and stays aligned with your future plans.

A short-term SIP is suitable for investors with goals in the near future and a lower risk appetite.

A long-term SIP is designed for investors aiming for higher growth over time.

A goal-based SIP helps you invest regularly with a specific financial objective in mind.

A tax-saving SIP allows you to invest regularly while also claiming tax benefits under applicable laws.

Accenture Analysis

SIP is one of the smartest ways to build long-term wealth with discipline, flexibility, and lower risk.

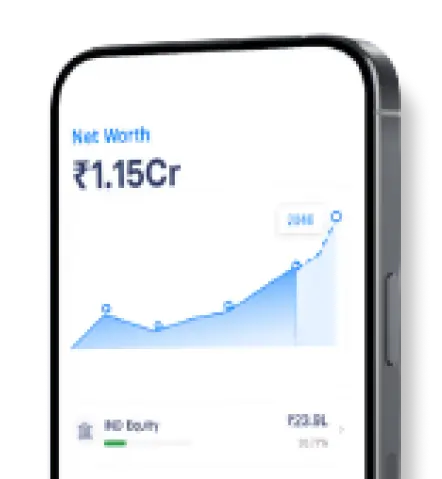

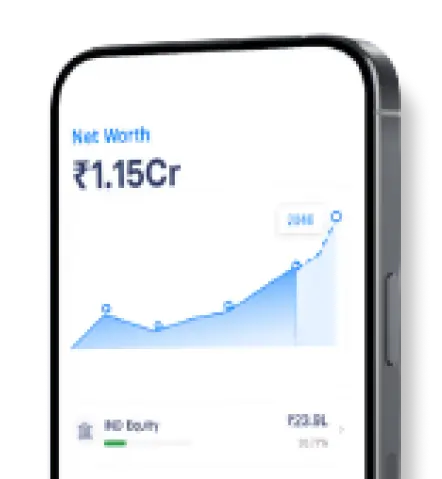

Goal Tracker helps you plan and monitor your SIP investments based on your financial goals. By setting clear targets such as wealth creation, education, or retirement, it calculates the right investment amount and keeps you on track with regular progress updates.

By investing a fixed amount at regular intervals, SIP reduces the impact of market volatility. You buy more units when prices are low and fewer when prices are high, which averages out your cost and lowers investment risk over time.

The power of compounding allows your SIP investments to grow faster over time as returns are reinvested. As your earnings start generating their own returns, the growth accelerates, especially when you stay invested for the long term.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Monthly Breakdown

Oct, 2024

Total Spent

₹1,250

NASDAQ100

NASDAQ 100 Index

₹111.73

▲ 2.56%

SPENT

₹1,800.00

Spending Summary

Last Week+8.5% vs prev.

Retirement Portfolio

₹1,15,087.80 est

Total Current Value • At Time

Chart

WeeklySpends

This Week

You can start a SIP online in just a few minutes with a simple, paperless process and minimal effort.

Step 1 of 5

Step 1

Enter PAN and Check KYC

Verify your PAN number and check if your KYC is completed.

Step 2

Select Best Funds

Choose the right mutual funds based on your goals.

Step 3

Add Funds in Cart

Add the selected SIP funds into your investment cart.

Step 4

1st Payment

Complete your first SIP payment using UPI to activate SIP.

Step 5

Activate Auto-SIP Setup

Set up your Auto-SIP mandate in a few simple steps.

GET THE APP

Faster KYC, smooth payments, and a clean investing journey - all in one place.

Join thousands of investors who trust us to manage their investments with confidence and ease.

“SIP makes investing simple and stress-free. It’s the best way to build wealth slowly and steadily.”

Long-term SIP Investor

This blog shares simple insights and practical guidance to help you understand SIP and make smarter investment decisions.

You can ask anything you want to know

We usually deliver the first blog post within 5-7 business days after receiving your brief and content requirements.

Yes, you can request edits and revisions to ensure your post matches your expectations perfectly.

Absolutely! Each blog post is written with SEO best practices in mind, including meta tags, keyword optimization, and structure.

Yes, you can cancel anytime through your dashboard. No long-term contracts or hidden fees.

We cover a wide range of industries, including tech, finance, education, lifestyle, and more.

Stay ahead with the latest updates, insights, and events from Macat Megatrons. Manage your SIPs, track investments, and grow your wealth smartly - all in one place.